Say, that some nice property you got there.

It'd be a shame if something... happened to it.

First let me explain what I mean when I say taxation is theft though.

All taxation is theft and extortion by definition. If Fat Tony rolls around demanding "protection money" from the local laundromat, we call that out as extortion, and rightfully so. The laundromat owner had no choice about contracting the mafia to protect him. They simply threatened him into accepting their "services".

But how is this different from the actions of a government? You do not "sign up" to be governed. If you think you're government's charging too high a price, you can't switch over to another company. The government is nothing more than the biggest mafia in town, both pretending to have some kind of "rightful claim" to your money, when you really have no choice about it. The only real difference here is that the taxman might actually believe his claim.

Your money or your life!

All government taxes aren't quite so obvious though. If I want to find out how much money was robbed from me directly in a sales tax, for example, it's right there next to all the legitimate trades on the receipt. I think I'm right in saying that people aren't "shocked" to find out the government took their own cut of a deal that had nothing to do with them.

Other ways are a little more surprising. For example, the inflation of a fiat currency.

Now what is inflation? How does it work? The simple answer is, money is a good, and like any other good, it is subject to the law of supply and demand. With a high supply of something, it's price drops because it's more easily attainable. We value rare things more highly *because* they are rare. If we gained the abilities of King Midas and could turn things to gold with a simple touch, the price of gold would not be very high.

So when the supply of money rises, when it inflates, the value of money falls. It has less purchasing power. You can't buy as much with the same amount of money any more, because that money is less valuable. The supply of something rises and falls for many natural reasons, like the discovery of a new gold mine for example, so you'd expect inflation in any society with any currency. However, as total supply is really hard to upset naturally, the value of money normally stays pretty consistent.

However, the inflation of a fiat currency is *not* a natural reason. Have you ever heard the phrase "money doesn't grow on trees"? The phrase means that money is not something easily attainable, and is used to encourage someone to save and to be more thrifty. People need to act responsibly with their money, and not be wasteful.

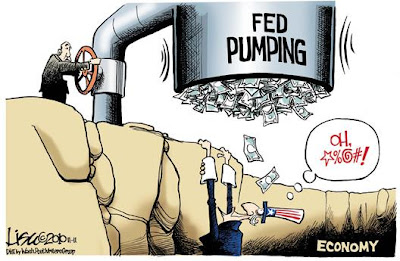

Well, for the Federal Reserve, money does grow on trees. Better yet, they don't even need to wait on the trees to bear fruit, they can just print the money themselves. If these banks are ever strapped for cash, they can literally just print money for themselves. This is not earned money. This is the creation of money ex nihilo.

How does this work out as theft from you and me though? That new money is getting it's value by stealing it from your saved money. While the central bank and government now have a lot of new money, the money you have is worth less and less. It is *exactly* the same as a tax.

Luckily for the ones printing the money, they are the last ones to feel the effect of the inflation. After they've printed the money, they still hold basically the same purchasing power as they did before. People haven't figured out that the money supply has gone up yet, and haven't had time to readjust prices.There are absolutely no downsides to them for printing more money. They have everything to gain and nothing to lose.

And it doesn't just stop there. Then these bastards have the nerve to loan the new money out and charge interest on it! But hey, I can't condemn charging interest entirely. After all, people need to be compensated for the sacrifice of their money over so much time. They worked long and hard to earn it. That money represents the contribution they've made to society by producing things people wanted, and we're creating an opportunity cost of what else they could have done with this money they earned oh wait this money was never earned the central bank just printed that money out of nothing and didn't do any work themselves even in the past to earn it nor are they taking on any personal risk by departing from their money!

And still! Still! Even while they're earning interest, if you miss your payment they get to take away your stuff as collateral! They can take your property away from right under your feet, at no personal risk for themselves. Not to mention that when the Federal Reserve loans it's money to the government, they have to tax you to pay for it! They have the all the money they could ever want, and can just sit back and get all your stuff too.

And the best part is, the nation never even sees it happening. You never face the taxation directly. All you know is that the price of everything seems to be going up, the economies in the tank, when you hear this great news from the central bank that they're going to get everything under control with nice sounding systems like "quantitative easing". You're not sure what that means, but it sounds soothing and really smart, so it must work, and you trust them to make things right.

I don't think I could come up with a more brilliant scam if I tried.

No comments:

Post a Comment